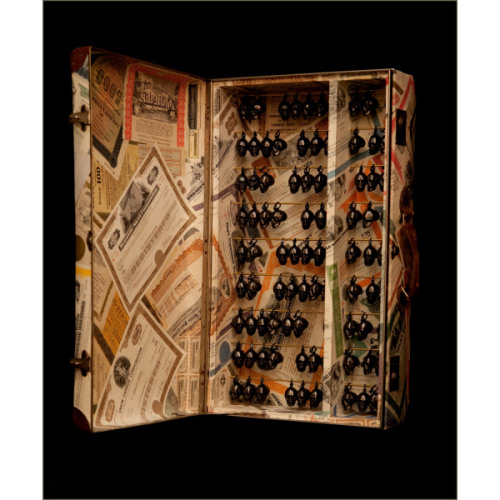

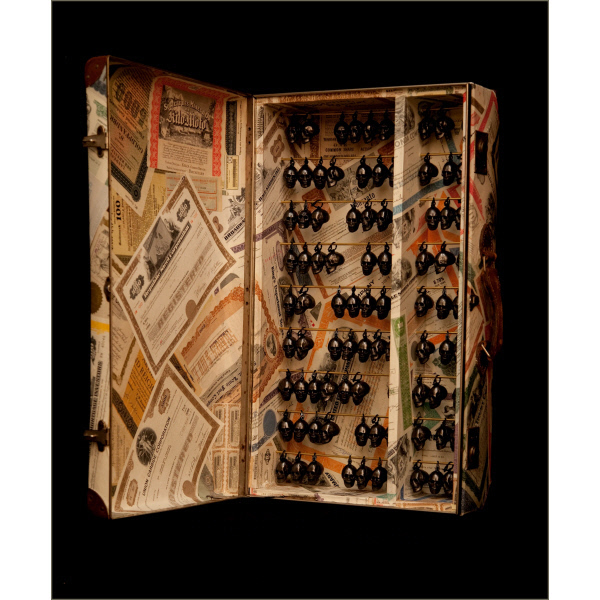

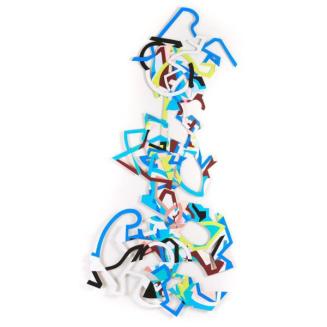

The Bottom Line

Künstler/in

Tim Sharp

(geb. 1947 in Perth, Schottland)

Date2012

ClassificationsObjekt

MediumMid-twentieth century Hungarian suitcase, Share and bond certificates, 90 Mexican mould-made black ceramic skulls, brass rods

Dimensions71 × 40 × 21 cm

Credit LineArtothek des Bundes

Object number28199

DescriptionThe Name of the Game and The Bottom Line are related pieces both of which are concerned with financial market, its rules and its relation to the real world. Three hundred years ago investing money in an enterprise made you a part owner in it, a partner, and as such you risked your entire fortune. Limited liability companies were regarded as morally inferior. Over the centuries, as the limited liability companies became the dominating legal entity for doing business, the communality between risk capital and actually being involved in the business undertaking became significantly more disassociated. Investors ceased to be responsible partners in the business, were no longer financially responsible for the debts of the company personally and only risked their capital to the extent of, and for as long as, their investment lasted, nowadays that can be microseconds. Their ‘shares’ in the company became increasingly easy to transfer. It was a situation that Adam Smith (and many others too) had warned of and it created a divergence between long term commitment to the success of the enterprise and the possibility of short term profits by taking advantage of fluctuations in the value of the company on the basis of projected events – earnings, dividends, take-overs, general economic climate etc. – in other words more or less well-informed betting. Aided by massive (anti-social) de-regulation, the last fifty years have seen a realignment of financial markets which have long ago relegated their original function of raising capital for business to a secondary––but none-the-less lucrative––position.

Since the two aspects are interlocked and a deregulated financial world has come to exercise increased pressure on companies, the tendency to devise methods to increase profits has become an overriding imperative which in turn perpetuates methods of socialising losses and liabilities while privatising profits. The cumulative results have been the impoverishment of the majority in favour of the enrichment of the minority. It has also created complex issues of taxation (avoidance and evasion) that hinder the creation of appropriate mechanisms for the redistribution of wealth for the common good.

The Name of the Game and The Bottom Line both attempt to draw attention to these developments in a way that is, in one sense, paradoxical. They are objects made in the recent past from materials and documents that are rapidly becoming historical. In a sense they stand for a crossroads, a pre-deregulation period when the business and financial worlds, were more connected to national territory in a physical, social and fiscal sense, more embedded in their respective communities despite that fact that their reach had been global since the sixteenth century – the earliest known share ‘certificate’ dates from 1606.

Since the advent of the computer and the deregulation of banking and finance, the trend has been towards paperless registration of shares and bonds. This is, of course, cheaper and faster and also reflects the increasing virtuality and speed of investment transactions. Nowadays the purchase and sale of investments may take place in milliseconds and informational advantage is also measured on the same scale. Put another way, transactions are now conducted at speeds that are completely divorced from human perception and they are often carried out by computer programmes which require no human decision-making, simply a little tweaking of the algorithms. Company accounting, taxation and production strategies have also been undergoing massive changes with company forms that are like Chinese boxes which switch to Russian dolls only to end up registered (for tax purposes) in a jurisdiction which does not provide information. Although it has always been the case that small-scale investors are at an informational, technical and structural disadvantage, it has recently become clear that agents they use (banks, brokers) do not necessarily act in their interests but, in the final analysis, their own. The rules have changed. The Name of the Game engages with this aspect in its doubly camouflaged incarnation as a gaming box where the dice are not free to roll but always count (the profit, not the real costs) and the process is decorated by female representations of the promise of wealth. When will the game be up?

The Bottom Line considers the paradox that while the transfer of investments and money cross borders largely unhindered and unquestioned by the dominant political and economic ethos, migrants, refugees and other travellers, i.e. real people, are restrictively controlled, registered, declared illegal and deported. The piece also touches on continuities of business practices over the last century by ‘picking the stocks’. The legitimate financing of state, communal body and company debt or investment, has again become increasingly tainted by taking into account only profit. And the results have been a history of ecological damage, negligent deaths (or worse), labour exploitation bordering on slavery, illegal manipulation of financial markets and massive financial losses of public and private monies through (wilful) dishonesty, imaginative accounting and clever deceits. The cheap products we consume are paid for (in part at least) by the health of the workers that produce them; the finite raw materials we use up (and discard) takes place in the search for short-term profits which find their way up the social ladder. The share certificates / bonds document a large enough proportion of these infractions to show that the pattern is inherent and structural. Without moral and political control the bottom line is a horror film. Almost as horrific as the Aztec skull racks (tzompantli). But at least in that latter case the victims and their families seem to have been honoured for their sacrifices.

(Tim Sharp)

[[missing key: detailactions.not-available-label]]